EMT

-

EMT STORY

-

EMT TECHNOLOGY

-

EMT NEWS & NOTICE

-

CAREER

-

EMT STORY

-

EMT TECHNOLOGY

-

EMT NEWS & NOTICE

-

CAREER

NEWS

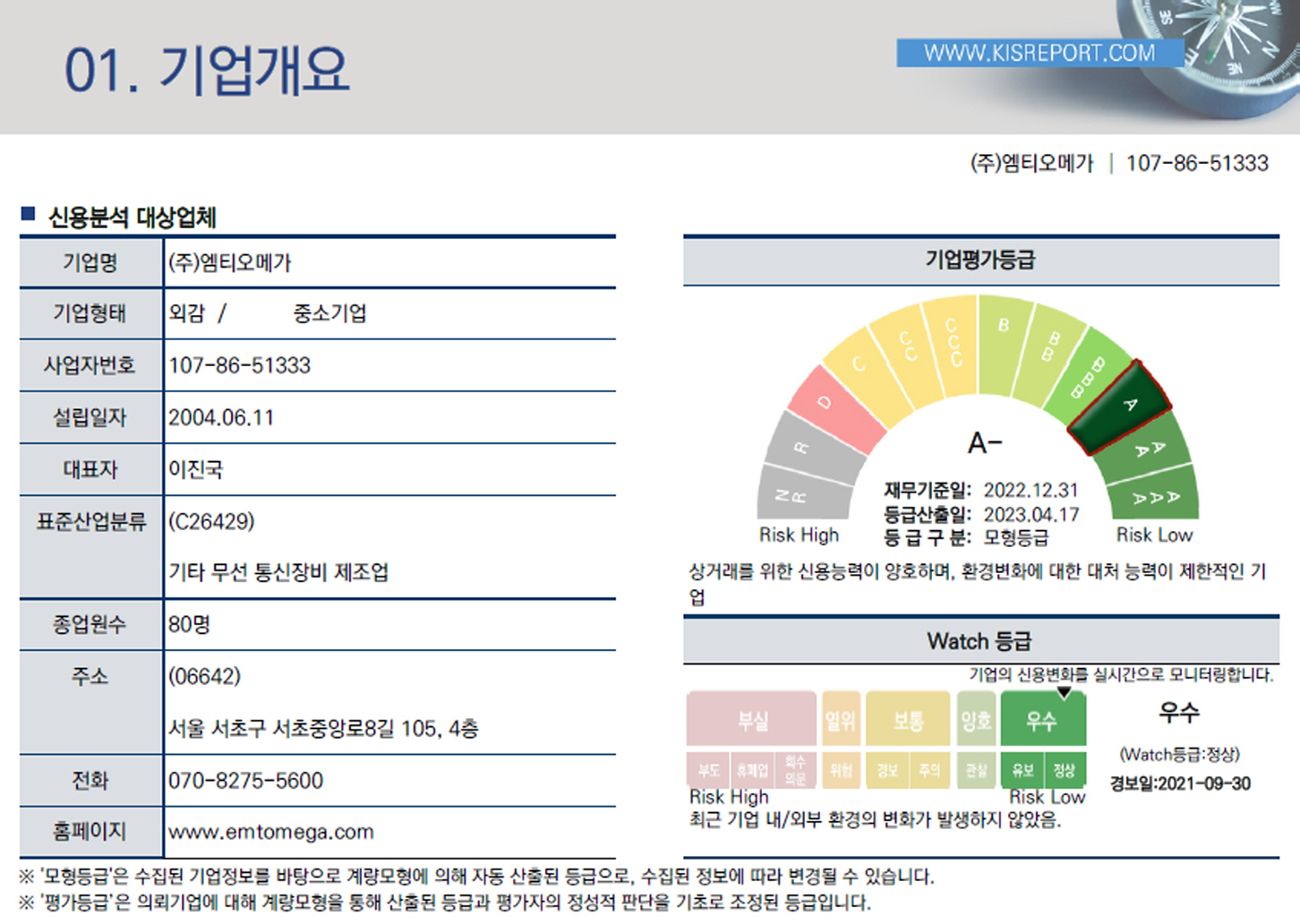

EMT Corporate Evaluation

Rating A- Upgraded_NICE Evaluation Information

■ Enterprise evaluation grade was

calculated by comprehensively evaluating the following items.

The credit analysis results of EMTOMEGA

Co.,Ltd are presented based on the latest data, the financial statements for

the settlement of December 31, 2022, and the data from the Credit Rating

Standards prepared on April 17, 2023.

▷ Stability Analysis

For stability analysis, equity

capital ratio and debt ratio should be considered.

EMT's equity ratio is 86.80% and

its debt ratio is 15.20% (industrial average equity ratio is 54.76%, debt ratio

is 82.61%)

▷ Liquidity analysis

In order to analyze liquidity,

the net operator's turnover rate and liquidity ratio should be considered.

EMT's net operator turnover rate

is 5.77 times and the current ratio is 700.62%. (Industrial average net

operator turnover rate is 4.09 times and the current ratio is 162.53%)

▷ Profitability Analysis

In order to analyze

profitability, we need to consider the net return on capital and financial cost

versus sales.

EMT's total return on capital is

19.67%, and financial cost-to-sales is 0.19% (industrial average total return

on capital is 3.31%, financial cost-to-sales is 1.46%)

▷ Growthability Analysis

In order to analyze growth, consider the rate of sales growth that evaluates the growth of a company's operating size and the rate of total asset growth that evaluates the overall growth of the company.

EMT's sales growth rate is -9.05% and total asset growth rate is 21.08%. (Industrial average sales growth rate is 13.96%, total asset growth is 14.27%)