EMT

-

EMT STORY

-

EMT TECHNOLOGY

-

EMT NEWS & NOTICE

-

CAREER

-

EMT STORY

-

EMT TECHNOLOGY

-

EMT NEWS & NOTICE

-

CAREER

NEWS

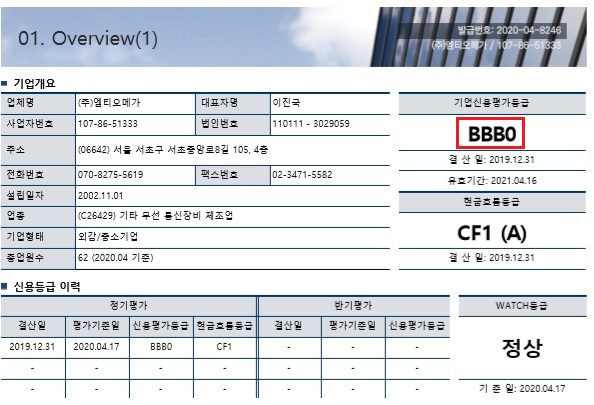

NICE evaluation information in corporate credit certification

Corporate credit rating grade : BBB0 (good)

Cash flow : CF1 (excellent)

WATCH grade : normal*

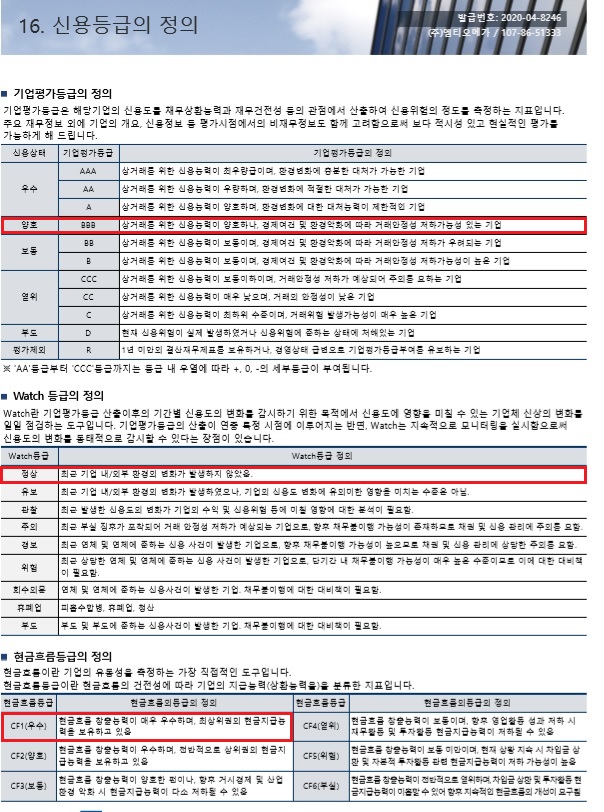

Corporate credit rating grade BBB0 (Good): A company with good credit capacity for commerce, but with the possibility of deteriorating transaction stability due to economic conditions and environmental degradation.

Cash flow CF1 (excellent): The cash flow creation ability is very good, and it has the highest cash payment capability.

WATCH grade (normal): There has been no change in the environment inside or outside the company recently.

*Increased profitability through sales growth

The company posted sales of 102,930 million won, an increase of 101.7% year-on-year, due to the expansion of orders for automobile dash cam and related software in 2019.

In terms of profitability, sales and operating profit margin improved 16.8% YoY and net profit margin reached 12.0% YoY, thanks to a reduction in expenses and eased manufacturing cost burdens.

*Maintaining a sound financial structure

In terms of financial stability, despite the expansion of the debt size due to the increase in the purchase debt, the stability index (Year-to-Equity Ratio 53.4%,

debt-to-equity ratio 87.1%, borrowing dependence 10.1%) was slightly higher due to the expansion of equity capital through retaining profits.

It improved and showed a solid financial structure. In terms of cash flows, cash flows from operating activities showed a positive (+) condition compared to the previous year, thanks to the increase in net profit size and increase in purchase debt.

As the end-of-term cash increased, it showed a smooth flow of funds.